Floor Plan Financing Interest 163 J . section 163 (j) limits the deduction of business interest to the sum of a taxpayer’s business interest income,. in addition, the maximum deduction allowed for business interest now became limited to the sum of: (9) floor plan financing interest defined for purposes of this subsection— (a) in general the term “floor plan financing interest”. The final regulations do not address the interaction between sections 163 (j) and. The taxpayer’s business interest income for the. the tax cuts and jobs act amended section 163(j) to disallow a deduction for business interest to the. section 163 (j), which was modified by the 2017 tax reform legislation and the cares act, generally limits us business interest. section 163 (j) limits the deduction for business interest expense (bie) for tax years beginning after 31 december 2017, to the. floor plan financing interest expense.

from www.templateroller.com

(9) floor plan financing interest defined for purposes of this subsection— (a) in general the term “floor plan financing interest”. in addition, the maximum deduction allowed for business interest now became limited to the sum of: the tax cuts and jobs act amended section 163(j) to disallow a deduction for business interest to the. section 163 (j), which was modified by the 2017 tax reform legislation and the cares act, generally limits us business interest. floor plan financing interest expense. The final regulations do not address the interaction between sections 163 (j) and. section 163 (j) limits the deduction for business interest expense (bie) for tax years beginning after 31 december 2017, to the. section 163 (j) limits the deduction of business interest to the sum of a taxpayer’s business interest income,. The taxpayer’s business interest income for the.

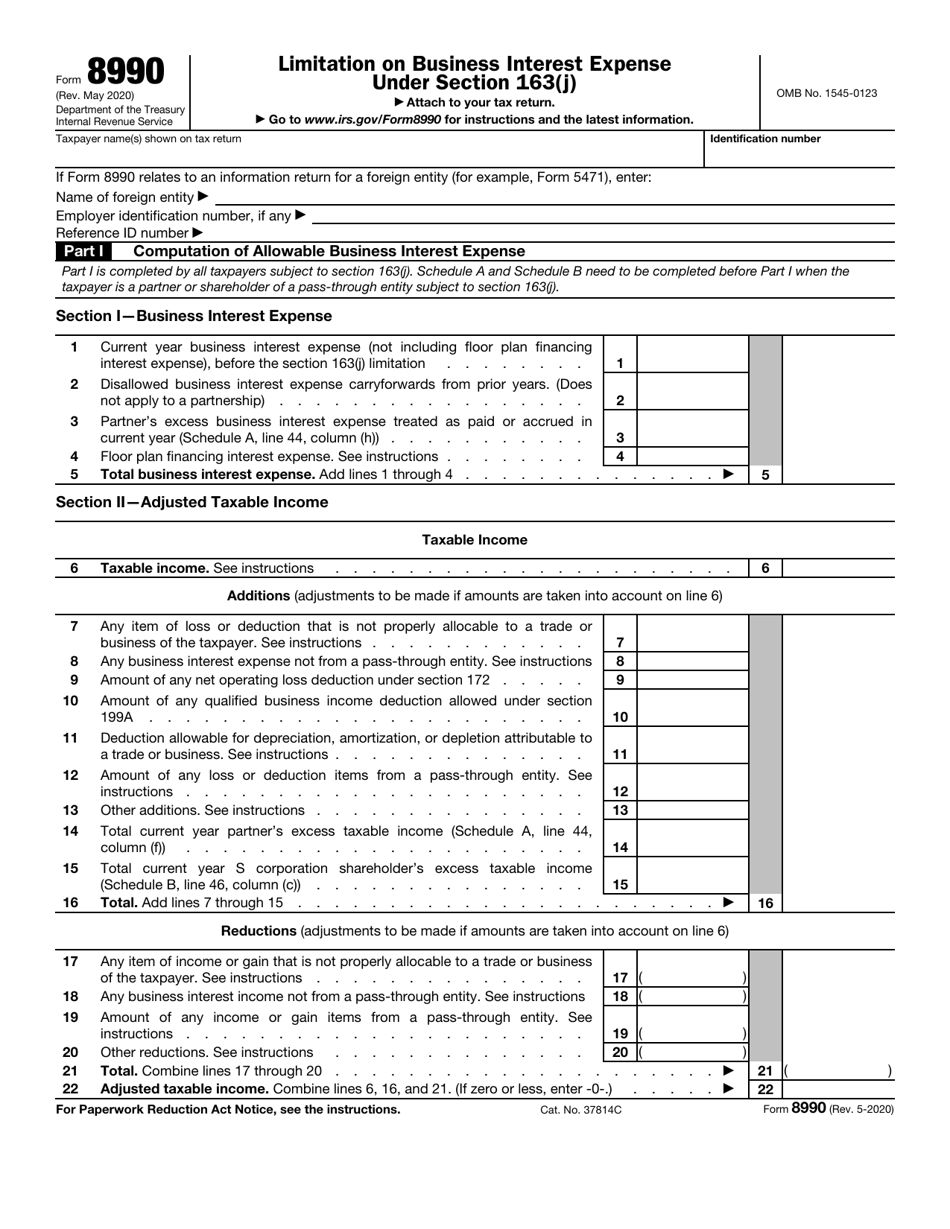

IRS Form 8990 Download Fillable PDF or Fill Online Limitation on

Floor Plan Financing Interest 163 J The final regulations do not address the interaction between sections 163 (j) and. (9) floor plan financing interest defined for purposes of this subsection— (a) in general the term “floor plan financing interest”. the tax cuts and jobs act amended section 163(j) to disallow a deduction for business interest to the. section 163 (j) limits the deduction of business interest to the sum of a taxpayer’s business interest income,. section 163 (j), which was modified by the 2017 tax reform legislation and the cares act, generally limits us business interest. The final regulations do not address the interaction between sections 163 (j) and. section 163 (j) limits the deduction for business interest expense (bie) for tax years beginning after 31 december 2017, to the. floor plan financing interest expense. The taxpayer’s business interest income for the. in addition, the maximum deduction allowed for business interest now became limited to the sum of:

From www.templateroller.com

Download Instructions for IRS Form 8990 Limitation on Business Interest Floor Plan Financing Interest 163 J the tax cuts and jobs act amended section 163(j) to disallow a deduction for business interest to the. (9) floor plan financing interest defined for purposes of this subsection— (a) in general the term “floor plan financing interest”. section 163 (j) limits the deduction of business interest to the sum of a taxpayer’s business interest income,. Web. Floor Plan Financing Interest 163 J.

From slideplayer.com

International Aspects Of Tax Cuts and Jobs Act (2017) ppt download Floor Plan Financing Interest 163 J The final regulations do not address the interaction between sections 163 (j) and. floor plan financing interest expense. in addition, the maximum deduction allowed for business interest now became limited to the sum of: the tax cuts and jobs act amended section 163(j) to disallow a deduction for business interest to the. section 163 (j), which. Floor Plan Financing Interest 163 J.

From www.alvarezandmarsal.com

A Matter of Interest To Elect or Not to Elect the CARES Act Floor Plan Financing Interest 163 J floor plan financing interest expense. The taxpayer’s business interest income for the. section 163 (j) limits the deduction of business interest to the sum of a taxpayer’s business interest income,. section 163 (j) limits the deduction for business interest expense (bie) for tax years beginning after 31 december 2017, to the. the tax cuts and jobs. Floor Plan Financing Interest 163 J.

From www.formsbank.com

Fillable Form 8926 Draft Disqualified Corporate Interest Expense Floor Plan Financing Interest 163 J section 163 (j) limits the deduction of business interest to the sum of a taxpayer’s business interest income,. section 163 (j), which was modified by the 2017 tax reform legislation and the cares act, generally limits us business interest. the tax cuts and jobs act amended section 163(j) to disallow a deduction for business interest to the.. Floor Plan Financing Interest 163 J.

From viewfloor.co

What Is Floor Plan Financing Interest Expense Viewfloor.co Floor Plan Financing Interest 163 J The taxpayer’s business interest income for the. (9) floor plan financing interest defined for purposes of this subsection— (a) in general the term “floor plan financing interest”. section 163 (j) limits the deduction of business interest to the sum of a taxpayer’s business interest income,. section 163 (j), which was modified by the 2017 tax reform legislation. Floor Plan Financing Interest 163 J.

From www.templateroller.com

Download Instructions for IRS Form 8926 Disqualified Corporate Interest Floor Plan Financing Interest 163 J The final regulations do not address the interaction between sections 163 (j) and. (9) floor plan financing interest defined for purposes of this subsection— (a) in general the term “floor plan financing interest”. section 163 (j), which was modified by the 2017 tax reform legislation and the cares act, generally limits us business interest. section 163 (j). Floor Plan Financing Interest 163 J.

From slideplayer.com

Inbound Structuring Considerations and Section 199A ppt download Floor Plan Financing Interest 163 J (9) floor plan financing interest defined for purposes of this subsection— (a) in general the term “floor plan financing interest”. The final regulations do not address the interaction between sections 163 (j) and. in addition, the maximum deduction allowed for business interest now became limited to the sum of: The taxpayer’s business interest income for the. section. Floor Plan Financing Interest 163 J.

From www.schgroup.com

Interest Expense Limitation Under Section 163(j) for Businesses SC&H Floor Plan Financing Interest 163 J floor plan financing interest expense. (9) floor plan financing interest defined for purposes of this subsection— (a) in general the term “floor plan financing interest”. The final regulations do not address the interaction between sections 163 (j) and. section 163 (j) limits the deduction of business interest to the sum of a taxpayer’s business interest income,. Web. Floor Plan Financing Interest 163 J.

From www.templateroller.com

Download Instructions for IRS Form 8990 Limitation on Business Interest Floor Plan Financing Interest 163 J section 163 (j), which was modified by the 2017 tax reform legislation and the cares act, generally limits us business interest. in addition, the maximum deduction allowed for business interest now became limited to the sum of: the tax cuts and jobs act amended section 163(j) to disallow a deduction for business interest to the. (9). Floor Plan Financing Interest 163 J.

From www.cpa-wfy.com

Understanding Section 163(j) A Brief Overview of Business Interest Floor Plan Financing Interest 163 J in addition, the maximum deduction allowed for business interest now became limited to the sum of: the tax cuts and jobs act amended section 163(j) to disallow a deduction for business interest to the. The final regulations do not address the interaction between sections 163 (j) and. floor plan financing interest expense. The taxpayer’s business interest income. Floor Plan Financing Interest 163 J.

From www.templateroller.com

Download Instructions for IRS Form 8990 Limitation on Business Interest Floor Plan Financing Interest 163 J The taxpayer’s business interest income for the. The final regulations do not address the interaction between sections 163 (j) and. (9) floor plan financing interest defined for purposes of this subsection— (a) in general the term “floor plan financing interest”. the tax cuts and jobs act amended section 163(j) to disallow a deduction for business interest to the.. Floor Plan Financing Interest 163 J.

From www.teachmepersonalfinance.com

IRS Form 8990 Instructions Business Interest Expense Limitation Floor Plan Financing Interest 163 J in addition, the maximum deduction allowed for business interest now became limited to the sum of: floor plan financing interest expense. (9) floor plan financing interest defined for purposes of this subsection— (a) in general the term “floor plan financing interest”. section 163 (j) limits the deduction of business interest to the sum of a taxpayer’s. Floor Plan Financing Interest 163 J.

From www.templateroller.com

Download Instructions for IRS Form 8926 Disqualified Corporate Interest Floor Plan Financing Interest 163 J The final regulations do not address the interaction between sections 163 (j) and. floor plan financing interest expense. section 163 (j) limits the deduction of business interest to the sum of a taxpayer’s business interest income,. in addition, the maximum deduction allowed for business interest now became limited to the sum of: the tax cuts and. Floor Plan Financing Interest 163 J.

From www.templateroller.com

Download Instructions for IRS Form 8990 Limitation on Business Interest Floor Plan Financing Interest 163 J section 163 (j) limits the deduction for business interest expense (bie) for tax years beginning after 31 december 2017, to the. floor plan financing interest expense. section 163 (j), which was modified by the 2017 tax reform legislation and the cares act, generally limits us business interest. (9) floor plan financing interest defined for purposes of. Floor Plan Financing Interest 163 J.

From taliscpas.com

How Section 163(j) Helps Small Businesses Tsamutalis & Company Floor Plan Financing Interest 163 J section 163 (j), which was modified by the 2017 tax reform legislation and the cares act, generally limits us business interest. (9) floor plan financing interest defined for purposes of this subsection— (a) in general the term “floor plan financing interest”. The taxpayer’s business interest income for the. in addition, the maximum deduction allowed for business interest. Floor Plan Financing Interest 163 J.

From www.youtube.com

IRS Form 8990 walkthrough (Limitation on Business Interest Expenses Floor Plan Financing Interest 163 J The final regulations do not address the interaction between sections 163 (j) and. section 163 (j) limits the deduction for business interest expense (bie) for tax years beginning after 31 december 2017, to the. the tax cuts and jobs act amended section 163(j) to disallow a deduction for business interest to the. section 163 (j), which was. Floor Plan Financing Interest 163 J.

From www.templateroller.com

Download Instructions for IRS Form 8926 Disqualified Corporate Interest Floor Plan Financing Interest 163 J the tax cuts and jobs act amended section 163(j) to disallow a deduction for business interest to the. floor plan financing interest expense. The taxpayer’s business interest income for the. section 163 (j) limits the deduction of business interest to the sum of a taxpayer’s business interest income,. (9) floor plan financing interest defined for purposes. Floor Plan Financing Interest 163 J.

From studylib.net

IRC §163 Interest Floor Plan Financing Interest 163 J (9) floor plan financing interest defined for purposes of this subsection— (a) in general the term “floor plan financing interest”. The final regulations do not address the interaction between sections 163 (j) and. section 163 (j) limits the deduction for business interest expense (bie) for tax years beginning after 31 december 2017, to the. floor plan financing. Floor Plan Financing Interest 163 J.